MDX.GN Resources

Request MDX.GN Data Access

Use our data request form to request access to Vista Index Data, Loan Identifiers, and Loan Level Details.

MDX Swap Price Discovery is Underway

Five dealers began submitting daily indicative bids and offers to ICE on MDX.GN Series 1 swaps this week to develop pre-trade price discovery. Using Wednesday’s ICE MDX Composite mid-market price* of 95.01, we highlight analytics available to market participants for the start of MDX swap trading in March.

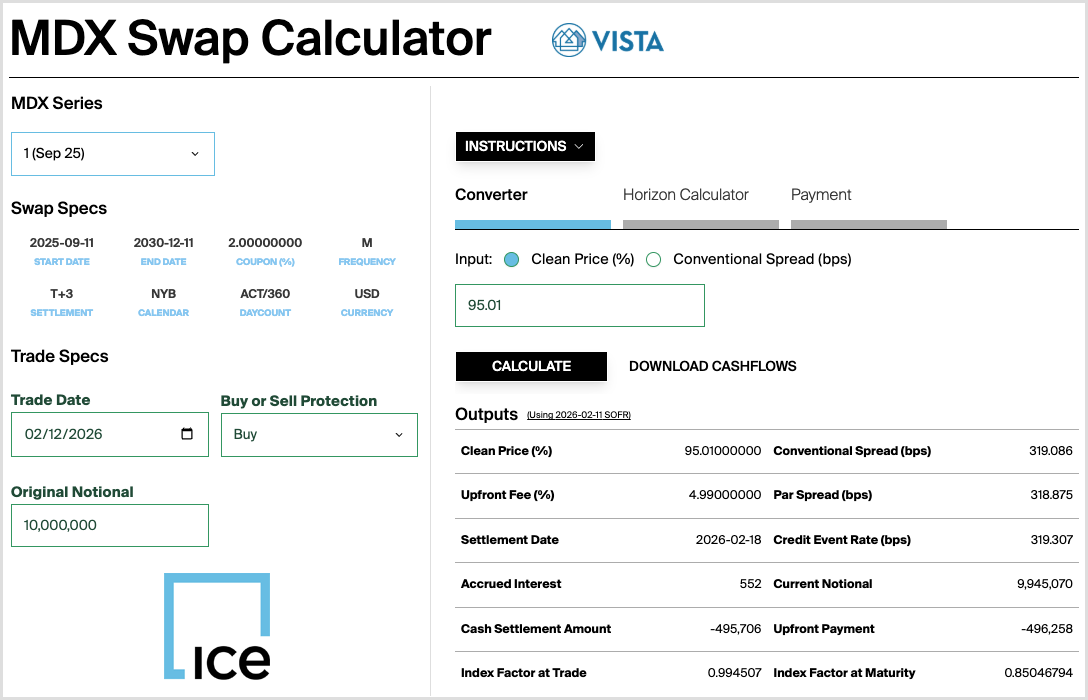

ICE-Vista MDX Calculator

Output from ICE-Vista MDX Calculator

The ICE-Vista MDX Calculator offers functionality to convert price to spread (and vice versa) for users. The pricing model discounts the expected future payments of the fixed and floating swap legs using a SOFR curve to calculate the equal net present value price (or spread) of the respective legs. The monthly fixed payments are based on the swap coupon rate, while the monthly floating payments are projected using a constant forward Credit Event Rate (see pricing methodology for additional detail) based on the calculated spread.

An MDX swap price can be used to model two key analytic outputs: Conventional Spread and Index Factor at Maturity.

The Conventional Spread is the spread that would make the present value of the fixed and floating leg payments equal given a Clean Price. Conversely, if Conventional Spread was used as the model input, the resulting Clean Price would reflect the same equilibrium. In this example, a 95.01 Clean Price equals a Conventional Spread of 319bps (rounded). Importantly, the Conventional Spread is not the loss-adjusted spread for the swap. Rather, this is the annualized Credit Event Rate where buyer and seller of protection break even. If Credit Events occur at an annual rate less than 319bps, the seller of protection earns a positive return; if Credit Events occur at an annual rate greater than 319bps, it produces a negative return.

The Index Factor at Maturity reflects the Credit Event Rate implied by the Conventional Spread over the entire swap term. The Index Factor at Maturity (above) of .85 (rounded) implies approximately 15 points of cumulative Credit Events. If cumulative Credit Events are less than 15 points, this Clean Price delivers an excess return for the protection seller. For context, the worst performing historical MDX.GN index tracking the 2019 vintage experienced 13.6 points of Credit Events over a swap term.

The Bloomberg Credit Default Swap Valuation (CDSW) function for MDX produces the same Conventional Spread calculations given a price.

Bloomberg Credit Default Swap Valuation function MDXGN501 Corp CDSW

Both the ICE-Vista and Bloomberg models adapt the ISDA CDS Standard Model for the specific attributes of MDX.GN swaps, offering hedgers and investors a simple loss-breakeven framework. For banks and originators looking to manage household debt exposures, they can use MDX.GN swaps to source protection understanding a loss coverage assumption. Likewise, investment managers can apply a straightforward scenario to model potential returns.

*DISCLAIMER: Please note that currently there is no trading in MDX. The indicative MDX composite prices are theoretical and provided as an indication as to where such instruments may trade should trading existed at the time of publication. The data provider makes no warranties whatsoever, either express or implied, as to merchantability, fitness for a particular purpose, or any other matter. Without limiting the foregoing, the data provider makes no representation or warranty that any data or information supplied to or by it are complete or free from errors, omissions, or defects. The data is a point in time output and as such dependent on and takes into account the information available to the data provider at the time of calculation. There are many methodologies (including computer-based analytical modeling) available to calculate and determine information such as the data herein. The data may not correlate to actual outcomes, and/or actual behavior of the market, such as with regard to the purchase and sale of instruments as they become available for trading. There may be errors or defects in data provider’s software, databases, or methodologies that may cause resultant data to be inappropriate for use for certain purposes or use cases.